The Future Is Probably Brighter With Blockchain

A sufficiently advanced perspective

I’ve been working in the crypto industry for several years and yet, I could never decide for myself whether blockchain is net good or bad for the future of humanity. I’m still unsure about many of the prospects but I’m convinced we should go for crypto even if it has a good probability of turning out to be an absolute scam.

Spoiler: it won’t turn out to be an absolute scam.

First and foremost, blockchain is much more about technology than it’s about markets and prices and Ponzi schemes. It is the technology that many proponents are backing. But why are they concerned with a technology that will give us decentralization, assert immunity from censure, and resolve privacy matters? Well, there is a reason.

Looming dystopia

In my search for the source material for this post, I’ve come across a thread painting vividly the grim future we could probably witness if Bitcoin were never invented. In short, we’d live in a dystopian nightmare with governments having all the power to monitor and control us — which they partly already have.

While the picture is probably too gloomy, I tend to agree that governments may go awry if not being constrained. It only becomes harder to control them as technologies continue to develop: cameras and GPS trackers are everywhere in the big cities, and slowly spreading out across the Earth. Financial information, now stored in databases instead of archives, has never been easier prey for taxation offices. Coupled with a rating system, like the one they’re implementing in China, that can get dangerously close to the future Alex described in his piece of fiction. Give it another 20 years and we may well find ourselves there.

When people attack the idea of blockchain, of course, they don’t vouch for the ability of governments to oppress us. They only try to defend the current status quo. As well, they often attack the wrong targets.

“Debunking” blockchain

To this day, many people still confuse blockchain with Bitcoin. They often target the latter, sometimes making a valid argument but most times not. When they try to get at blockchain as a whole, they still misdirect some of their blows — even though fears that drive them are totally understandable. Let’s check the most prominent takes.

Fiat currency

In one of the articles, the author puts fiat on the same list as borders, language, and culture. As if there were no country if not for paper banknotes. He says that state-issued money is designed to cancel debt while Bitcoin is not. Surprise, it is. The fact that Bitcoin (as well as other cryptocurrencies) is not widely accepted is a matter of time, not principle. The United States violated the status quo once when they fought for independence. If the dollar would have been brought about before their victory, it would have been immediately outlawed by the British Empire.

If something’s been around for a long time, that doesn’t mean it is necessarily good. For most of our history, slavery was legal. The death penalty still is in some countries. Fiat money is not nearly that bad of course, but it’s also not perfect. The desire to cling to the old ways is natural, it’s our inborn trait to be risk-averse, and change often goes along with risk. Sometimes, the lengths people go to in an attempt to rationalize their rigidity are absurd.

Conspiracy theories

I’m sure there are plenty of those but one of them is just driving me crazy. It’s from the same article that establishes fiat as one of the pillars of sovereignty. It postulates that Bitcoin is a “Chinese financial weapon against the US” and this statement follows from two premises: that China has banned cryptocurrencies, and that most of the mining is happening there.

The first premise is simply not true, or rather very imprecise: while China has banned its companies from providing crypto-related services and especially converting crypto to yuan and vice versa, the circulation of cryptocurrencies among individuals is legal and actively happening.

As for the hashrate dominance, the share of Bitcoin mining power coming from China plummeted from ~75% in late 2019 to ~65% in early 2020. During that period, the total contribution of the US-based mining pools grew from ~4% to ~7%. Recent statistics are difficult to find, but it’s hardly needed. From the latest news, a crackdown on Bitcoin is happening right now in China, which may have severe consequences for companies that have been involved in mining. It would be rather strange for CCP to shut down the “weapon” project while Bitcoin adoption is steadily growing in the United States. But let’s get back to our earthly matters.

Pump and dump

In 2021, some people still compare the hype around Bitcoin to the tulip bubble of the 17th century. Let’s imagine for a minute that it is really so — the worst outcome we can expect is another finitely long economic crisis. The worst outcome in a world without blockchain is an unending hell. Now let’s put it aside for a while.

Markets only constitute a part of the big and complex world of crypto. Alas, it’s the most visible part: easy to quantify, prone to catchy headlines, with the lowest entry threshold level. No wonder so many see blockchain through this lens.

Shallow critique picks at that part only, arguing that all of crypto is a multi-level marketing scheme with the only purpose to find bigger fools who will pump its price. The accusations of being a scam are seemingly more well-founded than the previous ones. We’ve witnessed bubbles within the crypto industry itself — the most notorious was the ICO boom of 2017. Right now the NFTs are gaining popularity while that market may be built of sand and fog. Many blockchain critics argue that the growth of Bitcoin price is bubble-like (and it may be so indeed). Finally, pieces of evidence exist that a solid fraction of volume on crypto exchanges is fake.

But again, all these allegations concern only the price part of the blockchain world. While Bitcoin might have been devised with only that purpose in mind, it’s important to remember that there are many other blockchain projects, some of which don’t have a cryptocurrency constituent at all. Blockchain as a technology has intrinsic value. At the very least, it allows us to exchange information without the fear of being blocked by a central authority.

Bad parts (for real)

There is no way for a technology to be perfect. It feels odd to me when the narrative is so much more intensive around prices than it is around energy consumption, crime, or scalability. Indeed, what you see is all there is.

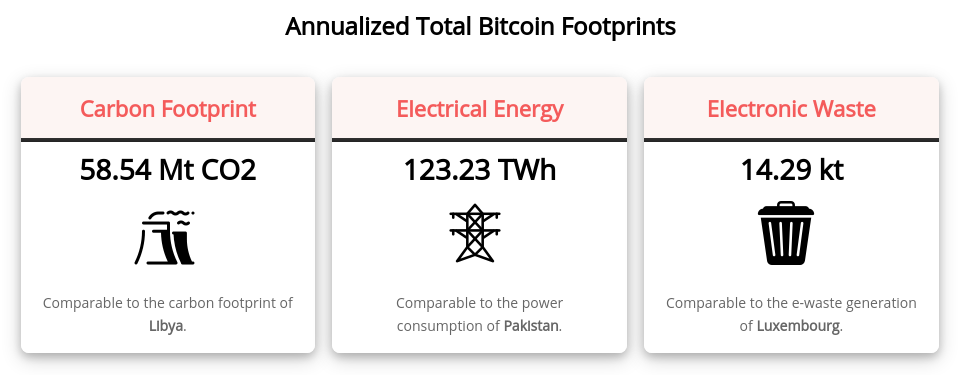

Energy consumption

Many know this to be a disproved myth. Indeed, gigawatts of power are wasted across the world where the grid capacity is greater than needed. But thankfully, that power goes to the mining pools. So if you see these scary numbers, please don’t panic: if not for proof-of-work blockchains, most of this power would likely go to waste.

Still, we shouldn’t stop at this point: with new consensus algorithms, we can reduce energy consumption even further. I, for one, would rather see the otherwise wasted electricity being spent on CO₂ recapture.

Criminal activity

The boldest claim I’ve seen says that roughly 40% of all crypto transactions are used for illicit activity. It states that while other sources give lower estimates, the trading volumes on major exchanges are mixed with the rest of transactions — thus making it seem like the rate of criminal activity is below 1% as reported here. And if we deduce the activity happening on the exchanges, the crime rate will be much higher. The exact methodology behind this claim is undisclosed and therefore dubious, but even if it’s true — the crypto world is young and yet unregulated.

Alright. Even if these rates are so high, why is that so? Not in the last place because many people have not yet employed blockchain for their needs. Even in the countries with the highest cryptocurrency adoption, the percentage of people who own crypto is almost always below 50%. No wonder why the share of illicit usage is so high, but that doesn’t mean that absolute numbers are gross.

Looking from a historical perspective, how many dollars were laundered? How much the crime rates were growing during gold-rush years in the regions concerned? We still use gold as a financial asset but we also use it for medicine and technology. I believe in the same fate for blockchain — as an example, it can refine the institutions that will otherwise rot.

Scalability

One of the fundamental problems of blockchain is that it’s not really good at scaling. A centralized system will always outperform a decentralized one in terms of throughput. Blockchain, on the other hand, has many features that beat any centralized system in terms of trust, provability, and security. I won’t write much about this but if you’re interested in the topic, I strongly recommend this great article by Vitalik Buterin.

Provable goodness

The breakthrough of Bitcoin was to find a practical solution to the Byzantine Generals Problem. But blockchain bestows us with much more. In his article, Balaji Srinivasan gives a list of arguments in favor of the technology. I want to elaborate on a couple.

Free speech

While social media ban their users, groups of enthusiasts here and there develop new, decentralized user networks that won’t have authority centers. It may also look like a bad thing: racists, extremists, and cultists will be spreading their lies without being punished. Precisely this creates an opportunity that people often miss.

Right now, governments lack incentives for fighting evil — it’s far too easy to block an account rather than play a long and costly game of social improvement. But when you can’t block (or even catch) a malefactor you become pretty motivated to encourage positive change. Of course, this is a double-edged sword, but what isn’t?

Smart contracts

For a long time, the imperfection of legal systems has been bugging me. People are fallible to a greater extent than algorithms. Laws and contracts composed by people in human language, however strict and specific, are fallible tenfold. Thankfully, we have a promise of a new legal practice — with distributed checks, bulletproof methods in the standard library of clauses, and bribery made off-limits.

Another point of Balaji’s article is that the famous imperative “Don’t Be Evil” can now be transformed into the indicative “Can’t Be Evil” with the power of smart contracts.

DeFi

A couple of weeks ago the cryptocurrency market suffered its worst crash in over a year with the leading coins suffering a roughly 30% decrease in their USD prices. Despite this, most of the major decentralized finance platforms worked normally and outlived the crisis. The total dollar value locked in DeFi surpasses 60 billion already. The fact that these platforms withstood the storm is a big deal: imagine what would happen to the traditional financial system if the Dow Jones lost almost half of its value in a matter of weeks.

A game-theoretical perspective

Let’s consider again the possibility that all blockchain startups and cryptocurrencies finally turn out to be an intricate fraud, and that by that time, trillions of dollars are in that scheme. Right then, the bubble pops.

What ensues in the worst case is a decades-long economic depression. Investigations, courts, poverty, and suicides. Even with a low probability of happening, this would be a time we would love to spare ourselves from. But what would await us in the future if there were no blockchain anymore, and governments wouldn’t stop their totalitarian march? It might be infinitely more dreadful.

In terms of estimated damage, what would the first event cost us? Let’s say 100 trillion dollars just to be sure — that’s more than the world’s GDP. And the probability of this is p₁ where 0 < p₁ < 1. But what’s the cost of an indefinitely long totalitarian dystopia? Even if its probability p₂ is orders of magnitude less than p₁ — the cost of it for us all is immeasurable, no sane person would like to live in that kind of future, not as a regular citizen at least.

So we come to an equation in which I assume the cost of the nightmarish future to be infinite. However big the difference between the probabilities is, the expected value of blockchain being a scam is capped at 100 trillion dollars while otherwise it cannot be capped at all.

As humanity, we have recovered from the direst crises. Those crises shared one crucial feature — they were finitely long. I’d rather risk another finitely long crisis than allow for even a tiny probability of falling into the trap of the absolute tyranny of the state.

Hello, friends! You might have noticed that the day and format have changed a bit. These are mostly cosmetic changes — I’m still planning to post regularly, even though I may deviate from the schedule now and then and post not strictly every two weeks. I’ve also replaced “Fortnightly Issue #N” with a more meaningful, relevant title.

I want to thank Ileana Almog and Ken Veerman for helping me with the title for this article, even though I went along with a different one. Without your suggestions, it would probably be a clumsy “Blockchain: Finally, Yes” or a dull “Why Blockchain Is Good.”

If anybody wants to support me with a donation, I’d rather you share this article. Though if you insist, the $1 pledge on my Patreon page is there specifically for this kind of support.

Thumbnail credit: Web Vectors by Vecteezy.

Thank you for reading, and till next time!